By the requirements of Massive Tech’s current pandemic increase, the begin to 2023 has hardly been a interval for the historical past books.

The primary-quarter development charges of three to 9 per cent reported this week by Alphabet, Amazon, Meta and Microsoft are a far cry from two years in the past, when surging demand for digital companies boosted Massive Tech’s mixed income by 41 per cent.

However at a low level of their current fortunes, the businesses nonetheless delivered a shock. Somewhat than seeing their companies fall again even farther from depressed fourth-quarter ranges, as had been broadly anticipated, Massive Tech’s development charges have turned again up once more.

Together with heavy cost-cutting that stemmed partly from a wave of job cuts, the income rebound buttressed the business’s revenue margins.

The stable monetary efficiency has buoyed confidence on Wall Avenue at an vital second. Buyers are making ready themselves for the tech business’s subsequent change in monetary course: an enormous enhance in spending to organize for the hoped-for generative synthetic intelligence increase.

“At large tech firms, we’re seeing monumental capex numbers,” stated Angelo Zino, senior business analyst at CFRA Analysis. “However we anticipate AI to supply incremental additions to income within the subsequent couple of years”.

The sturdy efficiency displayed this week confirmed that, regardless of being tied to economically delicate areas reminiscent of promoting and IT spending, the tech business’s greatest gamers have ridden out current financial uncertainty in surprisingly fine condition.

“The large tech firms are extremely resilient, much better than predicted,” stated Jim Tierney, head of US development investments at AllianceBernstein.

The newest figures included sturdy indicators the falling development charges in cloud computing — a key enterprise for Amazon, Microsoft and Google — had been coming to an finish, he added — one thing that will be “optimistic for the entire [tech] ecosystem” as suppliers to the enormous cloud firms see orders choose up.

On Thursday, Amazon was the most recent to ship robust first-quarter figures with revenues and earnings that topped forecasts.

AWS, its cloud computing division, has slowed sharply from the 37 per cent income development seen firstly of final yr. However at 16 per cent within the newest quarter it was nonetheless higher than feared, lifting hopes the slowdown could also be coming to an finish.

Nonetheless, essentially the most up-to-the-minute knowledge supplied by Amazon recommended it’s not out of the woods but. Development at AWS dropped additional to 11 per cent in April as prospects regarded for tactics to economize in a troublesome economic system, the corporate stated on a name with analysts.

The information despatched its share value into sudden reverse, greater than wiping out the 12 per cent achieve that had adopted the discharge of its first-quarter figures.

Regardless of this, Amazon’s stable first quarter appeared to substantiate Massive Tech had obtained off to a optimistic begin this yr. Microsoft had set the stage two days earlier than, reporting good outcomes for its personal cloud division and hinting the market was already turning up once more.

Chief govt Satya Nadella warned earlier this yr Microsoft’s cloud operations had been prone to undergo a yr of sluggish development as prospects tried to “optimise” their cloud contracts, a euphemism for searching for efficiencies to economize.

The flip could have come ahead of anticipated. “Sooner or later, workloads simply can’t be optimised a lot additional,” chief monetary officer Amy Hood stated on Microsoft’s earnings name this week.

Indicators that issues are enhancing factored a “little bit in our steering” for the present quarter, she added — a remark that fed hopes of stronger development and lifted Microsoft’s shares 10 per cent over the next two days.

An sudden return to development at Meta, after three quarters of contraction, recommended one other of Massive Tech’s core companies — digital promoting — was additionally performing higher than feared this yr.

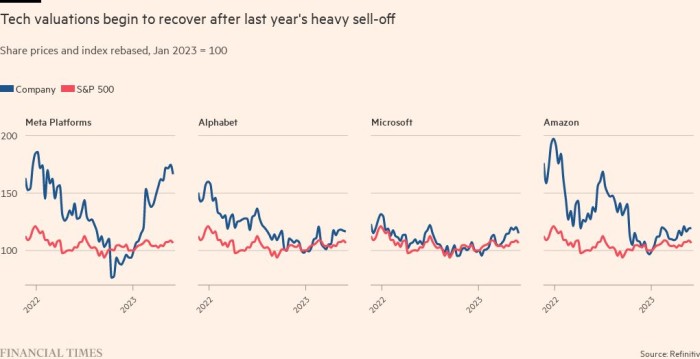

Mixed with extreme cost-cutting, the information boosted Meta’s shares 15 per cent, additional extending a robust rally for all the most important tech firms this yr.

A barrage of questions from buyers this week about generative AI confirmed, whereas the expertise behind OpenAI’s ChatGPT has but to turn out to be important in monetary phrases, Wall Avenue is already fixated on the brand new expertise.

“Buyers have been poring over the AI particulars supplied by the massive tech titans this earnings season, maybe extra so than every other concern,” stated Nigel Inexperienced, chief govt and founding father of deVere Group, a wealth administration agency.

What they noticed left a typically optimistic impression. Amazon boss Andy Jassy stated though general capital spending would fall again this yr, his firm was nonetheless upping its knowledge centre spending, partly in anticipation of a soar in demand fuelled by AI.

“Few of us respect how a lot new cloud enterprise will occur over the subsequent a number of years from the pending deluge of machine studying that’s coming,” stated Jassy.

Microsoft and Meta went additional, placing AI on the centre of their investor calls as they predicted the expertise would increase efficiency throughout their companies.

Mark Zuckerberg didn’t put a determine on the impression of his firm’s AI investments, however the Meta chief pointed to indicators the expertise was already having an impression. They included a 24 per cent enhance in engagement at Instagram, which the corporate attributed largely to Reels, its TikTok-like video service that relies upon closely on AI.

Early indicators like these added to confidence on Wall Avenue that as Massive Tech pours funding into the subsequent wave of AI, it should discover loads of methods to generate income from its costly new plaything.

“Microsoft’s pricing energy will soar as soon as it has AI embedded in its companies,” stated Zino. “I feel specifically that Meta did an amazing job of explaining how AI is working at the moment and the way it’s already enhancing content material. That could be a distinction from the metaverse, which continues to be such a distant prospect.”

If there was a shadow on the AI horizon, it was at Google, whose core search enterprise is broadly seen as essentially the most uncovered to the rise of generative AI. Dad or mum Alphabet was among the many firms to warn of upper capital spending stemming from AI, with prices beginning to rise within the second quarter and heading progressively larger from there.

Chief govt Sundar Pichai tried to reassure buyers Google would discover methods to include the upper prices of working AI-powered companies whereas additionally developing with new methods to generate income from them.

The dearth of particular particulars, nevertheless, didn’t calm the considerations and Alphabet’s shares fell again the day after it reported a return to development in its search promoting enterprise.