Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

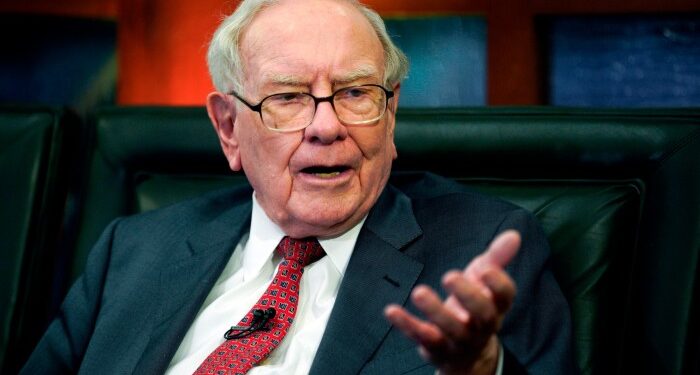

Warren Buffett, the world’s most well-known investor, stated he deliberate to step down from the helm of sprawling conglomerate Berkshire Hathaway, the monetary juggernaut he constructed up over the previous six many years.

The 94-year-old — generally known as the “Oracle of Omaha” — stated he would suggest that Greg Abel take over the management of Berkshire on the finish of this yr.

“The time has arrived the place Greg ought to change into the chief govt officer of the corporate at year-end and I wish to spring that on the administrators and get that advice,” he stated.

Abel, 62, whom Buffett had beforehand named as his eventual successor, is vice-chair of Berkshire’s non-insurance operations.

Buffett stated he had not given Abel or Berkshire’s different administrators any advance discover, making the announcement on the very finish of a historic sixtieth annual shareholder assembly in Omaha, Nebraska.

Berkshire is likely one of the world’s largest conglomerates, managing a portfolio of almost 200 companies. Buffett took it over in 1965 when it was a medium-sized textile maker.

Buffett plans to convene a gathering on Sunday with Berkshire’s board of administrators to reply questions on his determination.

“Two of the administrators who’re my youngsters know what I’m going to speak about,” he stated. “For the remainder of them, this may come as information”.

He added that he “would nonetheless grasp round and will conceivably be helpful in a number of instances”, however that the mantle ought to move totally to Abel.

The group of tens of 1000’s of shareholders who had descended on Omaha for the occasion erupted into applause following the announcement.

“That is completely monumental,” Christopher Rossbach, chief funding officer of longtime Berkshire shareholder J Stern & Co, stated by way of tears as he left the sector on Saturday afternoon.

“Berkshire Hathaway is an unbelievable enterprise and an unbelievable achievement. It stands for all the things that’s finest about American capitalism and entrepreneurship.”

Buffett is stepping down on a excessive. Berkshire “A” shares — the category held by Buffett himself and plenty of of his earliest buyers — closed on Friday at a document $809,808.50, a worth that mirrored not simply his long-term funding success but additionally the money pouring in from Berkshire’s working companies.

The inventory is up 20 per cent for the reason that begin of the yr, whereas the S&P 500 index has slid 3 per cent.

Buffett reassured shareholders that even whereas not formally main the conglomerate, he would maintain on to his Berkshire shares. “I’ve no intention — zero — in promoting one share of Berkshire Hathaway,” he stated. “I’ll give it away regularly.”

Berkshire now makes a lot of its cash from its huge insurance coverage enterprise, which incorporates firms comparable to Geico, in addition to myriad different firms from aerospace manufacturing to railways to chocolate retailers. The textile enterprise was shut in 1985.

Though he’s among the many nation’s richest people with a internet price of about $168bn, in response to Forbes, Buffett has maintained a folksy aura, attracting shareholders yearly to Omaha for a weekend of festivities. He nonetheless solely takes house a nominal wage of $100,000, as he has carried out for greater than 40 years.

The demise of his longtime good friend and enterprise companion Charlie Munger in 2023 elevated hypothesis about when Buffett may step down. On Saturday afternoon in Omaha, the reply lastly arrived.

“That’s the information hook for the day,” stated Buffett with a chuckle.