Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

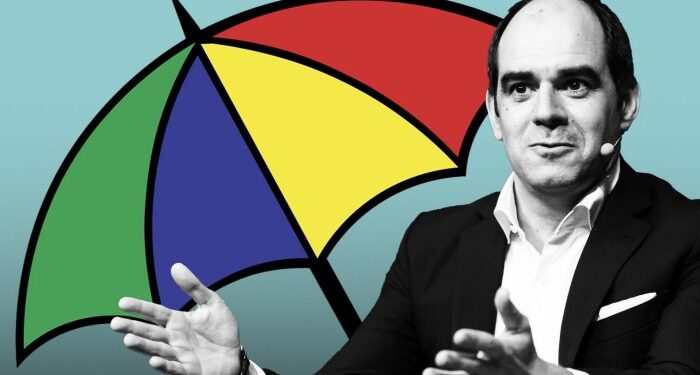

Authorized & Common, the British finance firm that’s one among Europe’s largest asset managers, has acquired an actual property investor as a part of a strategic push into personal markets below chief govt António Simões.

L&G, which manages £1.1tn in belongings, has taken a 75 per cent stake in Proprium Capital Companions, a $3.5bn world actual property personal fairness group, the businesses have confirmed.

Beneath the phrases of the deal, which is topic to regulatory approval, L&G will finally purchase 100 per cent of Proprium. The worth of the deal was not disclosed.

The transfer is a part of a broad strategic growth by L&G into personal markets following a restructuring of the FTSE 100 monetary providers enterprise by Simões, who took on the highest job final yr.

It comes after L&G poached Eric Adler from US insurer Prudential to guide its asset administration division, after combining the unit with its personal markets enterprise. The deal marks the primary acquisition below Adler, who is concentrated on rising L&G’s asset supervisor and increasing into personal markets globally.

The UK-based monetary providers group needs to spice up its personal markets belongings from about $50bn to $85bn and is focusing on £500mn to £600mn in working income by 2028.

L&G’s newest acquisition underscores how conventional asset managers are in search of to broaden into personal markets seeking increased returns.

A few of the world’s largest asset managers — together with BlackRock, Franklin Templeton and Capital Group — are expanding into private markets via acquisitions and partnerships with specialist suppliers. Personal asset funds include the potential to earn increased charges than for public market merchandise, however expose shoppers to new dangers.

L&G will present as much as $300mn to assist Proprium’s funds as a part of the deal. Proprium was spun out of Morgan Stanley’s actual property particular conditions crew in 2013. Its investments embody Germany’s A&O Hostels and pub group Admiral Taverns within the UK.

About 60 per cent of Proprium’s investments are in Europe, and the group additionally has a presence in Asia-Pacific. L&G says each areas are progress areas.

L&G’s actual property belongings quantity to about £22bn and embody large-scale regeneration tasks, industrial property and inexpensive housing. L&G additionally acquired an fairness stake final yr in US-based actual property investor Taurus, because it seeks to broaden its actual property enterprise past the UK, the place the majority of its belongings are targeted.

Adler stated the deal will broaden L&G’s geographical presence and assist to broaden its funding providing.

Tim Morris and Philipp Westermann, co-managing companions of Proprium, stated there was “immense alternative” in increasing into world actual property. The deal is ready to shut on the finish of the yr.

As a part of the settlement, Proprium’s administration crew will proceed to function independently and can hold its present management construction, groups and funding course of.