As technical training goes, few American establishments can match the status and affect of MIT. After all, not each graduate is destined for greatness, as two MIT alums made clear earlier this yr after they received busted for allegedly pulling a lightning-fast crypto heist, making off with an estimated $25 million.

The duo — two brothers named Anton and James Peraire-Bueno — had been lately indicted in a federal courtroom on fees of conspiracy, wire fraud, and cash laundering in what prosecutors name a “first-of-its-kind” monetary crime, according to Business Insider.

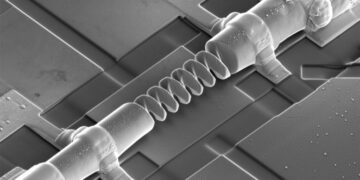

Within the opening section of the trial which kicked off this week, prosecutors described the heist as a “huge bait-and-switch” utilizing automated buying and selling bots to snare different bots right into a fraudulent transaction. In essence, the federal government alleges, the brothers exploited a software program flaw to sucker crypto bots into dumping thousands and thousands into their fraudulent forex.

“In 12 seconds, the defendants tricked their victims out of $25 million,” Federal Assistant Lawyer Ryan Nees advised jurors. “The defendants’ objective was to tear different individuals off,” he continued, including that the brothers “laughed about tricking their victims into shopping for sh**cash based mostly on their rip-off bait.”

Earlier than pulling off the scheme, BI experiences, the duo made positive to cowl their bases on Google, the place they searched “how one can wash crypto,” “high crypto attorneys,” “fraudulent Ethereum addresses database,” and — only for good measure — “cash laundering statue [sic] of limitations.”

The pair had been arrested earlier in May, after a two yr federal investigation revealed a months-long plot to control protocols used to validate transactions on the Ethereum blockchain, a cryptocurrency second solely to Bitcoin by whole market cap.

Peraire-Bueno’s attorneys, in the meantime, argue that as a result of the blockchain is an “unregulated market,” the duo had been merely deploying a novel buying and selling technique in a monetary setting the place “financial incentives information events’ habits.” In accordance to Decrypt, protection lawyer Patrick Looby asserts there’s “no central authority” or “authorities laws” overseeing the Ethereum blockchain — the entire draw of cryptocurrency within the first place.

Given the stakes concerned, the case is prone to set main authorized precedent, deciding the bounds — or lack thereof — on the US authorities’s authority to control a crypto market at present value over $3.5 trillion {dollars}.

Extra on crypto: Crypto Kingpin Turns Up Dead in Lamborghini After Market Crash