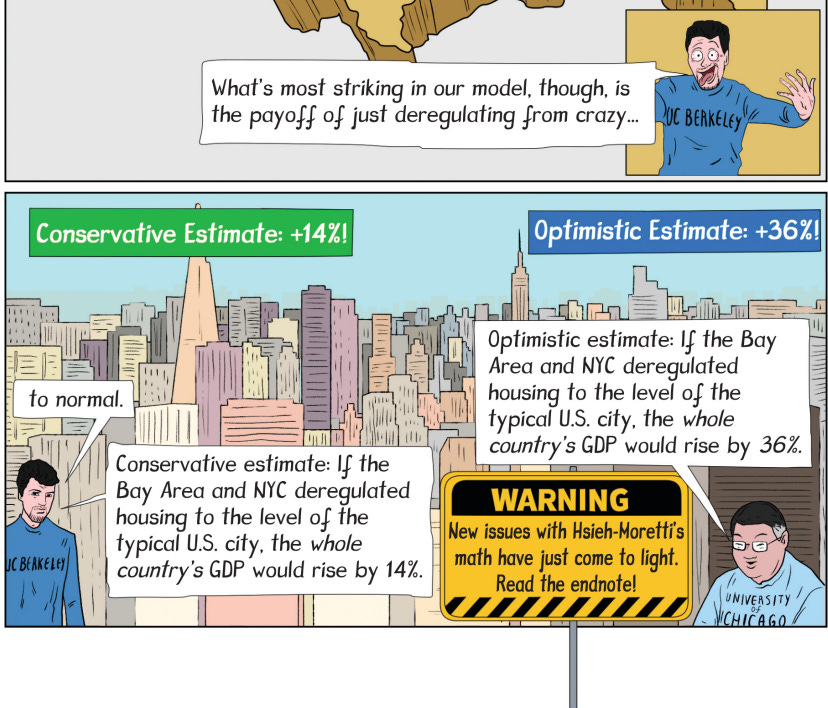

In 2019, Chang-Tai Hsieh and Enrico Moretti revealed “Housing Constraints and Spatial Misallocation” within the American Financial Journal. It is most likely academia’s most well-known Sure In My Yard (YIMBY) article. H-M imagined a state of affairs the place New York Metropolis and the Bay Space by no means imposed draconian housing regulation. Then they estimated how a lot larger the U.S. financial system would have been on this alternate historical past. Their reply was stunning. Restraining native regulation in simply two keys localities would have made whole U.S. GDP 4-9% larger.

The important thing concept: New York Metropolis and the Bay Space are the nation’s best areas. Given the identical inputs, they yield an exceptionally giant amount of output. In financial jargon, they’ve sky-high Total Factor Productivity. With a lot much less housing regulation, housing costs in these TFP-rich areas can be a lot decrease. Their populations would, in flip, be a lot larger. Manufacturing would naturally fall in low-TFP areas, however rise way more in high-TFP areas. Because of this, the full output of the nation would rise.

When writing Build, Baby, Build, I reviewed H-M intently. To my shock, I found multiple arithmetic errors, which Hsieh and Moretti shortly acknowledged. Surprisingly, my corrections really strengthened their outcomes. As an alternative of implying that GDP can be 4-9% larger, their paper really implies that GDP can be 14-36% larger. Tremendous stunning!

Not lengthy earlier than my guide went to print, nonetheless, economist Brian Greaney revealed a much more fundamental critique of H-M. This time, nonetheless, Hsieh and Moretti did not concede. Nor did Greaney. Given my time constraints, I made a decision to only insert a warning into the textual content and add an in depth endnote on the controversy. Like so:

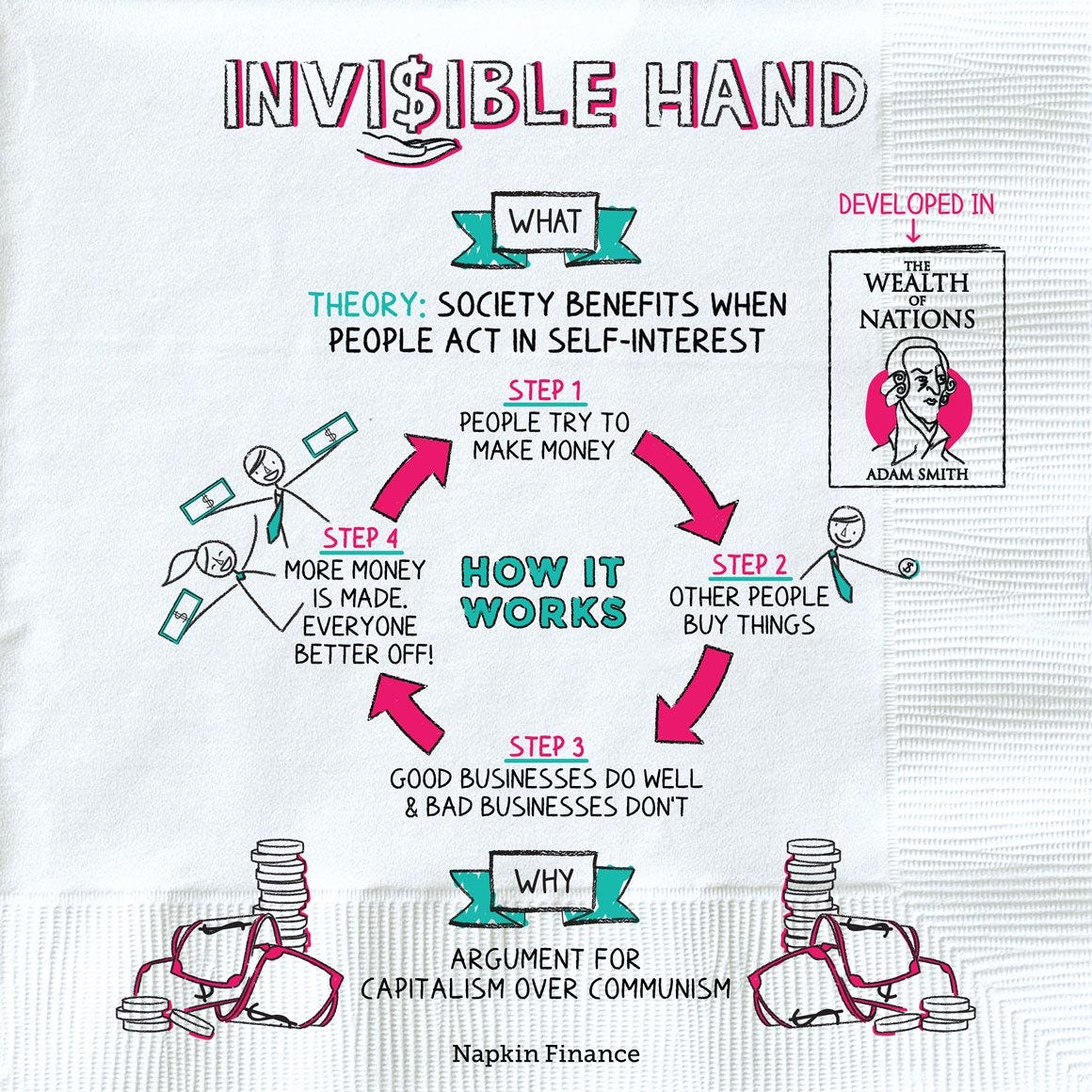

Lately, nonetheless, I began questioning what a fast “back-of-the-envelope” or “napkin” calculation would reveal. When I teach the economic effects of immigration, for instance, I usually begin by multiplying tough estimates of (a) positive aspects per immigrant by (b) whole variety of immigrants. In precept, one may do the identical for home migration. Why not give it a attempt?

After searching for simply accessible information and weighing a couple of completely different approaches, I did the next.

- I discovered information on imply earnings by schooling by state (plus Washington, DC) in Desk A6 of John Winters’ “What You Make Depends on Where You Live: College Earnings Across State and Metropolitan Areas.”

- To make life simpler, I solely did calculations for the “Excessive Faculty” and “Bachelor’s Diploma” calculations, and assumed that 2/3rds of staff had been within the former class, and 1/third within the latter. Close enough.

- I coded the next as having “Unhealthy Zoning”: California, Connecticut, DC, Massachusetts, Maryland, New Jersey, New York, and Rhode Island.

- I calculated population-weighted common imply earnings in Unhealthy Zoning states, and assumed that post-deregulation migration into the Unhealthy Zoning states can be proportional to their current populations.

- I assumed that if Unhealthy Zoning had been ended, the fraction of staff who would transfer was instantly proportion to the share wage achieve for his or her instructional class.

- I set an elasticity of .2, which means {that a} 5% wage achieve would induce 1% of staff to maneuver.

- Snapping these items collectively, I calculated per-worker annual greenback positive aspects for each instructional classes for all states. If a mover positive aspects $5000, however solely 2% of staff would really transfer, the per-worker achieve is $100.

- I can use inhabitants weights to calculate per-worker positive aspects for the entire nation. If, for instance, there have been two states whole, one with 1M folks and the opposite with $99M, the per-worker positive aspects for the nation can be 1% occasions the achieve within the first state plus 99% occasions the achieve within the second state.

Since this was an excessive amount of to truly write on a serviette, I set all of it up as a easy Google Sheet, which you can view (and tinker with!) here. Clearly you may lodge dozens of complaints about what I did, however I am simply going for fundamental plausibility.

This is what I discovered: Beneath my assumptions, GDP rises by $532 per employee, about +.8%. A lot decrease than H-M’s authentic decrease sure of +4%. Quite a bit in absolute phrases, however nothing transformative.

How delicate are the outcomes to the assumptions?

- The positive aspects are instantly proportional to the elasticity of .2 that I set in Assumption #6. For those who assume {that a} 1% wage achieve will immediate 1% of staff to maneuver, H-M’s preliminary decrease sure is right. However that appears loopy excessive.

- I used state-level information as a result of it was simpler. However Desk 11 in “What You Make Depends on Where You Live” has information on revenue by schooling for 104 metropolitan areas (MSAs). The poorest metropolitan areas are nearly as poor because the poorest states, however the richest metropolitan areas are markedly richer than the richest states. The non-metropolitan areas would usually be poorer nonetheless.

- Upshot: A thought experiment the place housing deregulation causes motion to the very richest metropolitan areas (slightly than simply the richest states) may plausibly yield positive aspects twice as giant as my preliminary estimates. If you wish to do the precise work, I am going to gladly run it as a visitor put up on my Substack.

Why are estimates of the home migration positive aspects a lot smaller than estimates of international migration gains?

First, as a result of positive aspects per capita are a lot bigger internationally. As Clemens, Montenegro, and Pritchett (CMP) present, immigrants from the Third World to the U.S. routinely multiply their income by a factor of 5 or 10. In distinction, transferring from the very poorest MSA (El Paso, Texas) to the very richest (Bridgeport-Stamford-Norwalk, Connecticut) multiplies highschool earnings by 1.6 and school earnings by 2.7. The largest intra-national positive aspects are about as huge because the smallest worldwide positive aspects in CMP.

Second, as a result of way more folks need emigrate internationally. Huge positive aspects encourage billions. Reasonable positive aspects encourage solely tens of millions, or maybe tens of tens of millions. Huge occasions huge is very large, however reasonable occasions reasonable stays reasonable.

The lesson: Hsieh and Moretti’s preliminary estimates had been all the time implausibly giant. Once I corrected their math, yielding even larger estimated results, I ought to have taken out a serviette for a fast plausibility test.

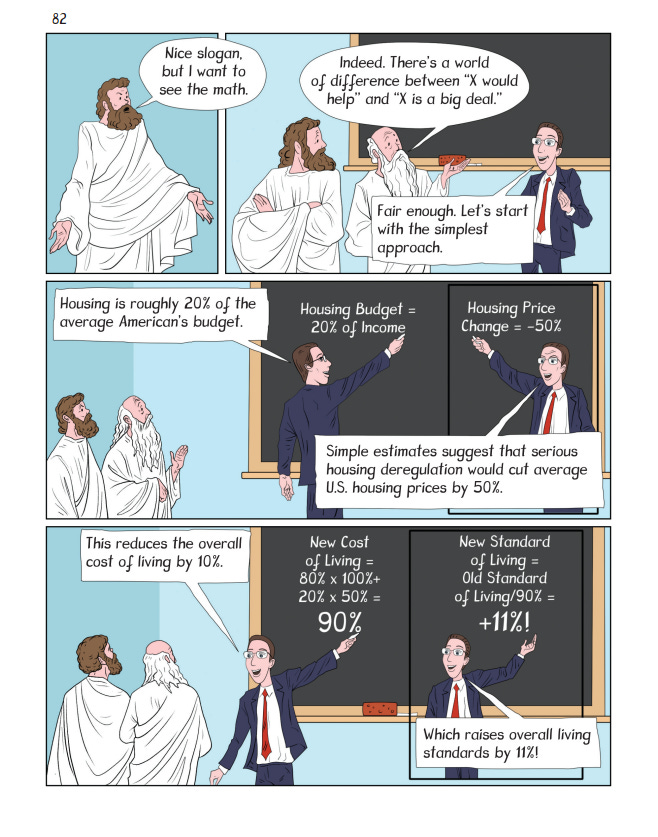

Happily, I’ve one other serviette. A greater serviette. The cleanest, clearest case for YIMBY is solely that (a) housing deregulation would sharply cut back housing costs (by about 50%), and (b) housing is a big share of the family funds (about 20%). So deregulation would finally reduce the price of dwelling by 10% — and lift dwelling requirements by 11%. (Read the book for details).

I am going to by no means get within the American Financial Journal with this argument, however I say it is strong.