Supreme Courtroom Justice Samuel Alito reportedly sold thousands of dollars of stock in brewing large Anheuser-Busch InBev whereas the corporate was embroiled in a tradition conflict controversy final summer season.

That was a silly determination.

No, not as a result of the timing of the sale means that Alito was taking part in a politically motivated marketing campaign in opposition to Bud Gentle, making an attempt to sign his opposition to transgender rights, or any of the opposite artificially constructed narratives which might be central to the media protection of Alito’s inventory sale, which was first reported by the Substack Law Dork. And, no, not as a result of there’s any ethical or moral significance to Alito’s determination (or anybody’s) to purchase or promote inventory in a sure firm. There is not.

The one factor we are able to say for positive about Alito’s determination to promote as much as $15,000 in Anheuser-Busch InBev inventory final summer season is that it value him cash. That is why it was a foul determination. On the finish of the day on August 14, when Alito reportedly bought the inventory, BUD was buying and selling at $56.35. In the present day, every share of the identical inventory is price over $66.

I hope Alito bought a thrill from sending that backhanded message to InBev’s bosses (if that was his intent) as a result of the chance value was doubtless a number of hundred bucks.

Voting together with your pockets is a reputable and useful factor to do, in fact. I am a bit extra skeptical concerning the thought of voting together with your inventory portfolio, nonetheless, as a result of promoting shares means giving up your rights as a shareholder and your capability to affect the corporate’s course. A gross sales boycott appears more likely to be more practical than an try at tanking a inventory value, which solely creates a chance for others to scoop up good shares at lower-than-usual costs. The market is much more sturdy than keyboard warriors on each proper and left would love you to imagine.

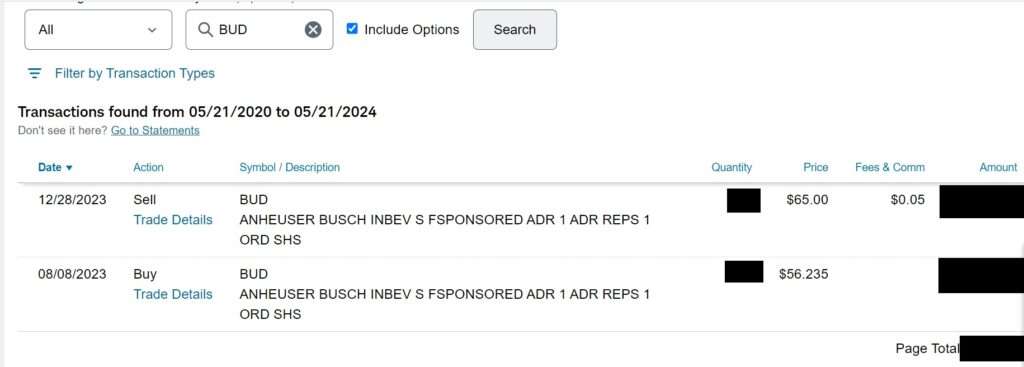

Working example: When conservatives began boycotting Bud Gentle and Inbev’s inventory value fell, I purchased it. I did not try this as a result of I care about Bud Gentle (it is a unhealthy beer that I typically keep away from shopping for and ingesting) or Mulvaney or as a result of I needed to sign some synthetic political level.

I did it as a result of I needed to make cash. Anheuser-Busch InBev is an enormous, profitable firm. The boycott appeared like a short lived setback that will cross as quickly because the conservative tradition warriors—who typically don’t have an impressively lengthy consideration span—bought outraged at one thing else. Purchase the dip, because the saying goes, and I did.

Positive sufficient, Bud Gentle did not vanish from American tradition—although the truth that Mexican import Modelo has not too long ago surpassed it as the most popular beer in the United States is an fascinating cultural story. (It certainly helps that Modelo has extra style.)

Neither did Bud Gentle’s dad or mum firm, which retains chugging alongside as one of many world’s largest, most profitable producers of alcoholic drinks. And after I owned a small share of the Anheuser-Busch InBev’s inventory, the corporate’s success was additionally mine—even when I by no means purchased a single case of Bud Gentle. Capitalism is nice like that.

(Full disclosure: I bought these shares of BUD in December when the inventory’s value hit $65 per share, equal to the place the inventory had been buying and selling within the days earlier than the too-online conservatives bought upset concerning the Mulvaney advert.)

Possibly Alito bought his BUD inventory to register a criticism in opposition to the corporate’s advertising technique. Possibly the commerce was executed mechanically as a result of Alito had set a “stop” order to promote the BUD inventory if its value fell under a sure degree. Regardless, as Nationwide Overview details, there’s nothing concerning the sale that appears to run afoul of judicial ethics guidelines.

Does this truth inform us something about Alito’s character or competence as a decide, as some are suggesting? After all not. However I’d advise in opposition to letting him handle your 401(ok), seeing how he bought that BUD inventory at simply concerning the worst doable time—the inventory has traded nicely above the $56 mark for a lot of the previous decade.

That is all that issues on this case. The inventory market exists so we are able to all profit from the wealth generated by profitable companies. Permitting the tradition conflict to get in the best way of that purpose is a disgrace—and probably a pricey one. Let’s not try this.