What You Ought to Know:

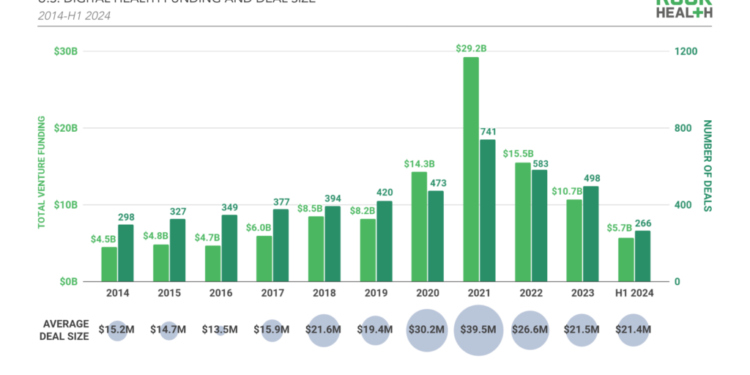

– The digital well being trade is displaying indicators of power regardless of latest financial uncertainties, in keeping with Rock Health’s latest H1 report.

– U.S. digital health startups raised a big quantity within the first half of 2024 ($5.7B), with the potential to exceed full-year totals from 2019 and 2023. This progress is fueled by sturdy Sequence A exercise, with a median deal measurement of $15M, indicating bigger investments for early-stage firms.

Right here’s a breakdown of key tendencies noticed in H1 2024:

AI Powering Innovation

Artificial intelligence (AI) is a serious driver of funding, with 38% of Sequence A-funded firms in H1 2024 leveraging this expertise. Massive early-stage funding rounds assist assist AI growth prices and gas innovation throughout varied areas of digital well being.

Shifting from Unlabeled Rounds

The prevalence of unlabeled funding rounds, used throughout market transitions, is reducing. This implies a return to a extra predictable funding panorama the place firms safe funding based mostly on designated phases (Seed, Sequence A, and so forth.). Nevertheless, some startups elevating consecutive unlabeled rounds may face difficulties in reaching profitability.

Digital Well being’s Evolving Panorama

Buyers are backing a wider vary of options past simply on-demand healthcare (telemedicine). Client tendencies, market adjustments like commoditization and specialization, and AI are all shaping the varieties of firms receiving funding.

Prime Funding Areas

Illness remedy, non-clinical workflow optimization, R&D for prescription drugs and medical gadgets, and medical workflow enhancements had been the top-funded worth propositions in H1 2024. Moreover, psychological well being remained the main medical focus, with important funding additionally directed in the direction of weight administration, reproductive well being, and menopause/pelvic well being options.

Return of Public Exits

After a protracted hiatus, three digital well being firms efficiently accomplished IPOs in Q2 2024. This alerts a possible uptick in public exits for the trade, with firms like Waystar and Tempus AI providing priceless insights into late-stage issues like debt administration and aligning exit costs with present market circumstances.

M&A Panorama

Whereas general acquisition exercise has declined, personal fairness corporations are taking part in a extra outstanding function in digital well being M&A. These corporations favor firms with established enterprise fashions and potential for profitability, providing alternatives for even financially challenged startups with clear progress methods.