What You Ought to Know:

– A brand new report from the Commonwealth Fund reveals that regardless of important progress in increasing medical insurance protection beneath the Reasonably priced Care Act (ACA), thousands and thousands of People nonetheless lack ample and inexpensive healthcare.

– The report highlights the prevalence of protection gaps, excessive out-of-pocket prices, and the burden of medical debt, underscoring the necessity for additional coverage motion to attain really common protection.

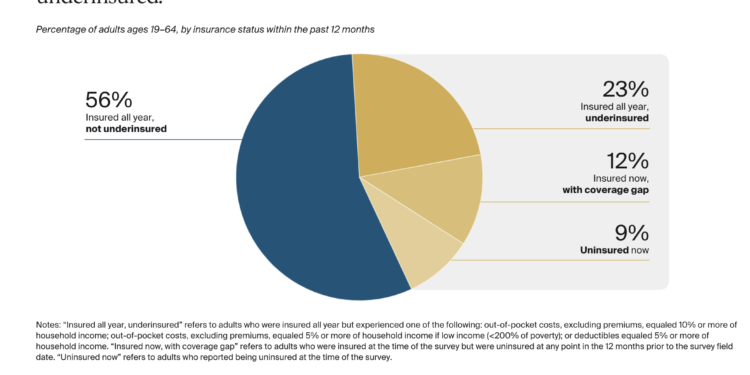

Uninsured and Underinsured

Whereas the uninsured charge has declined considerably for the reason that ACA’s implementation, many People nonetheless expertise gaps in protection or are underinsured, which means their well being plans don’t present inexpensive entry to care. Different key findings of the report embody:

- Employer-Based mostly Protection: A majority of underinsured adults (66%) have protection via their employers, highlighting the constraints of employer-sponsored medical insurance in offering ample monetary safety.

- Price-Associated Boundaries to Care: Greater than half of uninsured and underinsured adults reported skipping mandatory healthcare, together with physician visits, exams, and medicines, on account of price.

- Medical Debt: Over one-third of working-age adults who have been uninsured or underinsured are burdened by medical debt, usually resulting in additional delays in care and monetary hardship.

- Well being Penalties: Delaying or skipping care on account of price has severe well being penalties, with many people reporting that their well being worsened because of this.

Coverage Suggestions to Tackle Healthcare Affordability

The report emphasizes the necessity for coverage motion to deal with these challenges and enhance healthcare affordability and accessibility. Key suggestions embody:

- Prolong Enhanced Tax Credit: Make everlasting the improved market premium tax credit, that are set to run out in 2025, to stop premium will increase and protection losses.

- Tackle Medical Debt: Take away medical debt from credit score reviews and strengthen protections in opposition to aggressive debt assortment practices.

- Enhance Insurance coverage Affordability: Decrease deductibles and out-of-pocket prices in market plans and alter premiums and cost-sharing in employer plans primarily based on earnings.

- Increase Medicaid: Set up a federal fallback choice to cowl the thousands and thousands of uninsured people in states that haven’t expanded Medicaid.

- Promote Steady Protection: Permit states to take care of steady Medicaid eligibility for adults for 12 months to stop gaps in protection.

“The Reasonably priced Care Act has lined 23 million folks and lower the uninsured charge in half. However excessive prices are a major problem for a lot of People, whatever the sort of insurance coverage they’ve. Congress, employers, insurers, and well being care suppliers all play a job in decreasing prices and making care extra inexpensive, so households can keep away from debt and get the care they should keep wholesome,” stated Sara R. Collins, lead examine creator and Commonwealth Fund Senior Scholar and Vice President for Well being Care Protection and Entry & Monitoring Well being System Efficiency.

Report Background/Methodology

The Commonwealth Fund 2024 Biennial Well being Insurance coverage Survey was performed between March and June 2024, involving a nationally consultant pattern of adults aged 18 to 64. The survey supplies worthwhile insights into the state of medical insurance protection within the U.S. and informs coverage suggestions to enhance healthcare entry and affordability.