This text is an on-site model of our FirstFT e-newsletter. Subscribers can signal as much as our Asia, Europe/Africa or Americas version to get the e-newsletter delivered each weekday morning. Discover all of our newsletters here

As we speak’s agenda: Fed cuts US outlook; EU probes BYD plant; Israel’s “endlessly warfare”; Turkey’s authoritarian slide; and Europe’s meme inventory second

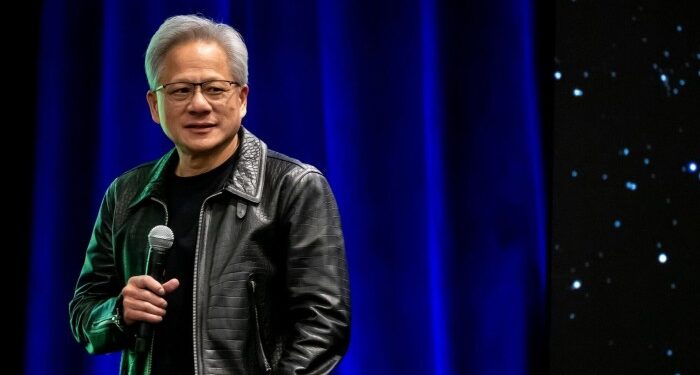

Good morning. We begin with a wide-ranging interview with Jensen Huang, who spoke to the Monetary Instances as Nvidia unveiled its newest synthetic intelligence chips on the firm’s annual builders’ convention.

What are Nvidia’s plans? The corporate will spend tons of of billions of {dollars} on chips and different electronics manufactured within the US over the following 4 years, the chief government mentioned, because it tilts its provide chain again from Asia. Huang added that Nvidia was now in a position to manufacture its newest programs within the US by way of suppliers reminiscent of Taiwan Semiconductor Manufacturing Firm and Foxconn.

What’s behind the transfer? America’s greatest expertise corporations have turn out to be overwhelmingly reliant on TSMC’s cutting-edge chipmaking services in Taiwan. That dependency has been clouded by the rising risk of aggression by China — which claims Taiwan as a part of its territory — in addition to Donald Trump’s threats of tariffs on Taiwanese semiconductors. “A very powerful factor is to be ready,” mentioned Huang.

We have more from Nvidia’s CEO, together with his ideas on Intel and Chinese language rival Huawei, and extra on AI under:

Right here’s what else we’re conserving tabs on right now:

-

Financial knowledge: The European Central Financial institution publishes its financial bulletin, the UK has labour market figures and Germany has its producer value index for February.

-

UK fee choice: The Financial institution of England is anticipated to hold interest rates steady. For extra on financial coverage, sign up for Chris Giles’ Central Banks e-newsletter for those who’re a premium subscriber, or improve your subscription here.

-

EU summit: Leaders from across the bloc will discuss Ukraine and regional defence plans once they meet in Brussels.

-

Outcomes: Accenture, CK Hutchison, FedEx, Lloyd’s of London, Micron and Nike report.

5 extra prime tales

1. The Federal Reserve slashed its US progress forecast and lifted its inflation outlook yesterday, whereas conserving its principal rate of interest on maintain. Fed chair Jay Powell instructed reporters that President Donald Trump’s tariffs had affected “a good part” of the central bank’s outlook.

2. Unique: The EU is investigating whether or not China supplied unfair subsidies for a BYD electrical automotive plant in Hungary, in a extremely delicate transfer to focus on the deepening financial ties between Beijing and Viktor Orbán. Ought to Brussels discover that the Chinese language firm benefited from unfair state support, these are the actions it could take.

3. Trump proposed that the US take over Ukraine’s nuclear energy crops in a cellphone name with Volodymyr Zelenskyy yesterday. The Ukrainian president additionally agreed to again an American proposal to halt strikes on Russian power infrastructure. Here’s more from their call.

4. Elon Musk’s X has raised about $1bn in a brand new fairness funding spherical that values the social media firm at $44bn, bringing its valuation again according to the value the billionaire paid in 2022. Musk, X’s majority shareholder, was amongst those that bought the shares. Here were some of the other investors.

5. Unique: China is boosting state assist for home minerals exploration as policymakers pursue the nation’s objective of self-sufficiency amid intensifying competitors with the US. Not less than half of China’s 34 provincial-level governments introduced extra subsidies or expanded entry for mineral exploration prior to now 12 months, an FT analysis shows.

Information in-depth

With Israel renewing its offensive in opposition to Hamas this week, 1000’s of reservists within the Israel Protection Forces now face the prospect of an instantaneous return to warfare. But it’s unclear how rather more they will take. For ever and ever, specialists and reservists have begun to warn of growing attrition on the fighting force, with jobs, households and lives placed on maintain.

We’re additionally studying . . .

-

Turkish politics: The arrest of Recep Tayyip Erdoğan’s principal rival marks a dangerous turning point within the nation’s authoritarian slide, say politicians and traders.

-

EU ‘strategic autonomy’: Trump has pushed the bloc from “prices an excessive amount of” to “whatever it takes”, because it cuts dependence on US programs reminiscent of Starlink, writes Alan Beattie.

-

UK Spring Assertion: The chancellor’s technique subsequent week is to steer a gentle ship in uneven waters, writes Chris Giles. That’s positive — for now.

-

Bezos and Trump: Amazon’s founder has executed a sharp public reversal in his relationship with the president that has stunned even longtime associates.

Chart of the day

In an echo of the “meme inventory” craze of 2021, a handful of European shares have turn out to be a battleground for retail merchants taking over hedge fund brief sellers. Small-scale merchants — some co-ordinating their efforts on Reddit — have turbocharged good points in these corporations, which have far outstripped a broader rally led by the defence sector.

Take a break from the information . . .

Securing a restaurant reservation has by no means been tougher. Fortunately, our meals columnist Ajesh Patalay has insider tips for landing a table.