For household enterprise house owners, the choice to promote all or a part of their enterprise is commonly probably the most troublesome moments of their lives. One or a number of generations’ work and legacy are being placed on the block, with expectations and feelings working excessive. How have you learnt you’re getting the proper worth? What do it is advisable to do to draw the proper patrons? To what extent can the household, together with the following era, stay concerned with the enterprise?

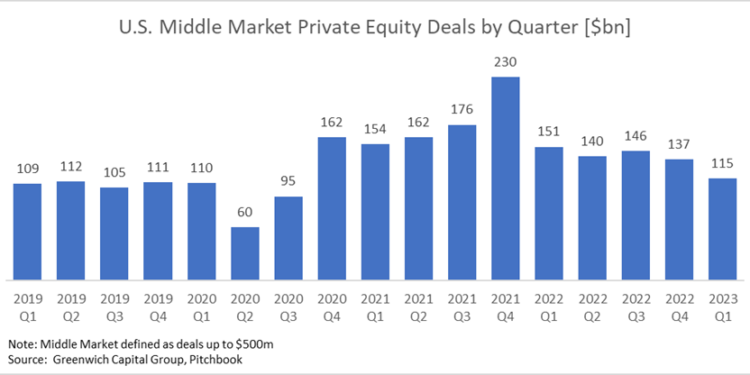

The quick temptation, usually strengthened by advisors, shall be to deal with optimizing monetary issues. However the actuality is that making an attempt to “time the market” is extraordinarily troublesome. Wanting on the previous few years with excellent hindsight, an proprietor “ought to have” bought their enterprise within the final quarter of 2021, when purchaser curiosity and multiples reached a historic peak. Because the graph beneath illustrates, that peak was brief lived.

Greenwich Capital Group, Pitchbook

For full-year 2022, center market M&A declined 21% in value and 10% in volume from the prior year, and virtually two-thirds of PE corporations anticipate M&A volumes in 2023 to be lower or flat compared to 2022. Since even a easy gross sales course of takes two or three quarters, and most processes have important twists and turns, a enterprise timing the height would have been the equal of a surfer making an attempt to catch waves working at a number of occasions their pace.

So, if optimizing monetary issues is so troublesome already, what concerning the different issues and complexities affecting the sale of a household enterprise – legacy, satisfying a large number of stakeholders, and expectations? It seems that if an proprietor accurately navigating by means of these issues, greater than the timing of any transaction, usually simplifies the method and sometimes results in the proprietor feeling assured that she made the proper determination a couple of sale, her future, and the way forward for the enterprise.

Do You Hate Mondays?

At Brightstar Capital Companions, we steadily converse with household enterprise house owners who’re considering a sale however aren’t positive that they’re able to make that large leap. Earlier than entering into the monetary and valuation facets, we ask them a sequence of easy questions, akin to:

- Do you hate Mondays?

- What makes you excited concerning the enterprise?

- Is there one thing you’d moderately be doing along with your life post-sale?

- What are the targets and aspirations of the following era?

“Do you hate Mondays” is our metaphor for, “do you not benefit from the considered an intense 5 days forward, working and working your enterprise?” It opens the door to a dialog about what kind of hands-on partnership with a brand new investor may work – and restores a love of Mondays.

All these questions goal to get the proprietor centered on these parts of the sale determination that transcend pure economics. We imagine these parts will assist the house owners select the proper associate for a possible transaction, the place the household might be assured their enterprise is in the proper fingers for the following section of progress. And with the proper partnership, monetary issues might be optimized over an extended interval moderately than only one sale occasion – the equal of a surfer being towed again out to catch the following large wave.

Contemplating the aspirations and readiness of the following era can also be a significant a part of the sale determination. The North America Family Business Report 2023, not too long ago printed by Brightstar Capital Companions and Campden Wealth, discovered that the overarching aim of “Subsequent Gen” relations is to guard and maintain the household enterprise, in accordance with 81% of survey respondents. That stated, 22% of the household enterprise house owners surveyed felt there have been no subsequent era members both keen or sufficiently certified to take over. Taking the time to doubtlessly prepare the following era is a much more vital name than making an attempt to optimize market timing.

It’s also vital for house owners to guage if the enterprise is actually prepared for a sale. We inform house owners that it may take as much as 18 months to get a enterprise into sale-ready form. Potential patrons will conduct an intensive due diligence course of, and would require (amongst different issues):

- Up-to-date, audited enterprise data, contracts, provider agreements

- Audited monetary statements

- Proof of strong infrastructure, significantly on the expertise and cyber aspect

- Properly-established management buildings and danger administration processes

The excellent news is that every one these diligence steps in the end make the enterprise stronger – so they’re worthwhile whether or not or not a sale takes place. And within the case of a sale, they may also help discover a higher associate, positioning the enterprise and household legacy for long-term success. Our expertise may be very clear – long-term imaginative and prescient and persistence is what has made so many household companies into the powerhouses they’re. We’re assured that it’s also the proper method when trying on the sale of the enterprise – house owners ought to keep answerable for timing till the day the gross sales paperwork are signed.

Observe me on Twitter or LinkedIn. Take a look at my website.