Liudmila Chernetska/iStock through Getty Photos

Abstract

This submit is to offer my ideas on Reynolds Client Merchandise (NASDAQ:REYN) enterprise and inventory. REYN manufactures and distributes family packaging merchandise. The corporate provides preparation, cooking, cleanup, and storage options similar to aluminum foils, plastic wrap, oven luggage, and gradual cooker liners. Reynolds Client Merchandise serves clients worldwide. Regardless of an improved enterprise relative to pre-Covid, my advice is a maintain score, because the inventory appears to be pretty valued based mostly on my DCF mannequin.

Funding thesis

REYN beat the consensus EPS estimate within the most recent quarter by $0.02, reporting $0.32 EPS for 2Q23. Natural gross sales development of three% was primarily pushed by pricing development of three%. Regardless of robust quarterly advertising for its foil enterprise, quantity was flat. That stated, I consider the advertising efforts put in 2Q23 ought to have spillover results to 3Q and future quarters as REYN noticed double digits improve in media impressions throughout main media platforms. Administration additionally deliberately boosted its reliance on social influencers and different applicable media to attain this larger stage of family penetration amongst millennials and Technology Z. These efforts ought to result in sustainable quantity ranges shifting ahead. As well as, in the course of the 2Q23 name, administration talked about that COVID allowed the corporate to reset its commerce program, and because of this, the corporate diminished the variety of commerce promotions it ran in 2020 and 2021. In consequence, sources have been directed towards implementing tried-and-true commerce promotion packages and worth level optimization. Subsequently, whereas quantity was flat this quarter, I anticipate it to choose up ultimately as REYN promotional methods are simpler now.

As well as, I consider the enterprise isn’t much more sustainable from an natural demand and margin perspective as gross sales that had been pushed by promotion at the moment are a decrease than the 25% throughout pre-covid. This supplies administration with quite a lot of leeway in maximizing quantity (shelf area) by way of promotion each time obligatory with out sacrificing revenue too drastically. The Reynolds wrap product is an effective instance of this technique in motion; REYN launched momentary worth reductions [TPR] and required retailers to successfully preserve them for a set time frame as a way to safe shelf area and improve demand. Since TPRs have been so efficient with foil, I anticipate that administration will use the identical technique with their different product traces, which is a lever that administration can pull to extend quantity development.

Specializing in the amount a part of the story once more, I anticipate REYN’s built-in enterprise mannequin to profit from potential commerce downs. REYN’s pricing on this mannequin is versatile, permitting the corporate to search out the candy spot the place costs and demand intersect. 2Q23 supplied robust proof that that is true as Reynolds wrap elevated its market share within the aluminum foil market by over 5pts on account of elevated shopper acceptance and decrease retail costs, closing the value hole with non-public label merchandise.

Reynolds Wrap gained greater than 5 factors of brand name share within the foil class, gaining much more share than within the first quarter. Reynolds Wrap is responding to an enchancment in retail worth factors and worth gaps versus retailer manufacturers, a return to vacation commerce promotions, which had been very nicely acquired by retailers and shoppers over Memorial Day and main into the 4 of July. 2Q23 earnings results call

Because of these elements, gross margin elevated by 419bps to 24.3%, the EBIT margin got here in at the next than anticipated 12.8%, and the EBITDA margin hit its goal of 16%. Administration elevated the underside of the FY23 vary on account of the 2Q beat, although the 3Q information is anticipated to be barely weak. Administration has forecasted a decline in Q3 income of between -3% and -5%, with costs remaining secure and volumes falling. On the subject of the amount decline, I consider it’s nothing structural. On-retail gross sales are liable for 2% of the decline, whereas retail gross sales are liable for the opposite 2%. For the latter, it’s largely as a result of demand pulled ahead as a result of Memorial Day and July 4th holidays, which drove households to replenish their family inventories. Subsequently, I consider it’s cheap to anticipate decrease unit gross sales in 3Q. Lastly, REYN can also be lapping its worth will increase final yr, making comps barely harder vs the previous few quarters. The excellent news is that administration has acknowledged that they anticipate quantity development of three% in This fall. With simple 4Q22 comparisons and rising demand within the essential vacation season forward, REYN should not have any hassle clearing this bar.

Valuation

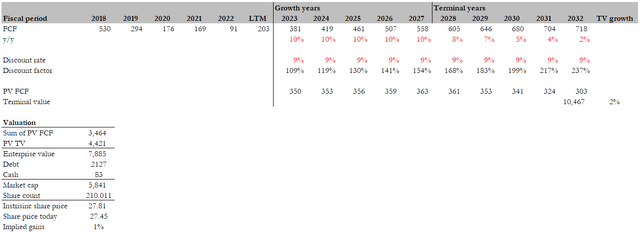

I consider the honest worth for REYN based mostly on my DCF mannequin is $28. My mannequin assumptions are that REYN will develop sooner than the business price of low single digits over its development years because it captures share through simpler promotion methods and its built-in mannequin. Ultimately, development will decline to a terminal development price of two%, reflecting enterprise maturity. The enterprise is barely cyclical; therefore, I assumed a 9% low cost price, 100bps increased than the S&P 500’s historic long-term return.

Personal calculation

Threat

As REYN sells numerous plastic-related merchandise (wraps, and many others.), it faces the continuing danger of environmental sustainability. Whereas this has not impacted the enterprise in any main manner, incremental stress from traders specializing in ESG elements would possibly scale back funds invested in REYN. This could affect inventory valuations.

Conclusion

To sum up, REYN has proven enchancment in comparison with pre-COVID instances, but its valuation seems pretty priced. Administration’s efforts to reinforce family penetration amongst millennials and Technology Z, adaptable pricing and commerce promotion methods, together with an built-in enterprise mannequin, are anticipated to drive quantity and margin enhancements. My valuation utilizing a DCF mannequin suggests a good worth of $28, making the present share worth pretty valued.