phototechno

Funding thesis

Our present funding thesis is:

- Endava has achieved spectacular progress, nicely in extra of its friends, whereas additionally having superior margins, pushed by another method to competitors. The corporate has developed a robust model, is targeted on advanced transformational workouts, is lively in conducting M&A, and seeks to recruit high-performing people.

- The corporate’s shopper progress is powerful and its high clients are being diluted as a % of income, implying Endava is profitable with cross/up-selling its purchasers.

- We consider business tailwinds will assist robust progress within the coming years, notably from AI, as corporations search to combine the know-how into their operations.

- Endava is buying and selling at a FCF yield of 5.8% and a small premium to its friends, regardless of its robust monetary and business efficiency. This suggests upside in our view.

Firm description

Endava (NYSE:DAVA) is a world know-how companies firm that gives IT consulting, software program growth, and digital transformation options to assist companies innovate and keep aggressive. Headquartered in London, the corporate operates in varied industries, serving purchasers throughout North America, Europe, and Asia.

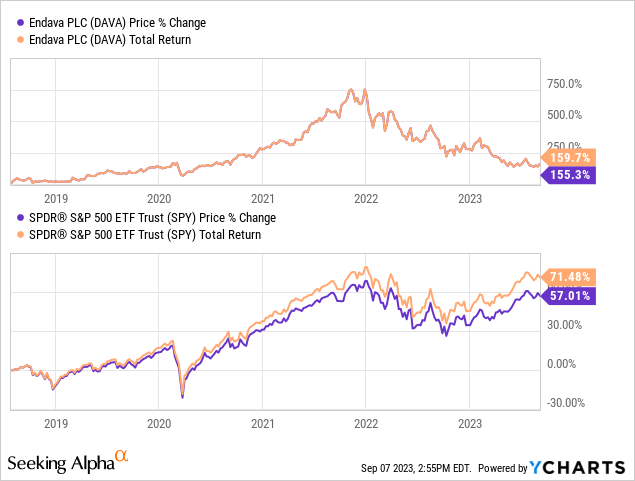

Share value

Endava’s share value efficiency has been robust because it was listed, though noting a speedy deterioration from its peak on the finish of 2021. The share value actions are a mirrored image of traders’ altering sentiment and expectations of the corporate’s long-term trajectory.

Monetary evaluation

Endava monetary efficiency (Capital IQ)

Introduced above are Endava’s monetary outcomes.

Income & Business Components

Endava’s income has grown exceptionally nicely over the past decade, with a CAGR of 35% into the LTM interval. This progress has been extremely constant, with no interval under 20%.

Enterprise Mannequin

Endava assists companies in navigating the digital age by providing companies and options that allow digital transformation. This contains software program growth, cloud migration, knowledge analytics, person expertise design, and extra. The corporate’s goal is to be a accomplice to purchasers looking for to develop their operational and business capabilities as technological change materially disrupts their industries.

Endava’s method is completely different from a lot of its friends, looking for to distinguish itself by means of the event of manufacturers synonymous with high-quality companies and a novel method to problem-solving. We consider it is a key cause for the corporate’s progress as IT consulting and Digital Transformation has skilled a interval of commoditization, contributing to a race to the underside. Endava is looking for to interrupt this by differentiating itself, with its income exhibiting the success of this method.

Endava offers its companies throughout a spread of industries however has developed its experience in what we might describe as “conventional” or “archaic” industries, these with the broadest scope for technological enchancment. As the next illustrates, Administration estimates that there’s important progress remaining inside these core markets.

Endava is a world enterprise, incomes 56% of its income in Western Europe & the EU, with an additional 24% in non-EU international locations (We suspect a lot of which is the UK), adopted by 15% in LatAm and three% in North America. This diversification reduces any danger of focus to native headwinds, whereas permitting the enterprise to develop its manufacturers and whole addressable market.

A key alternative we see with that is North America. The corporate’s publicity to the market, which is the most important on this planet, is minimal. Given the extent of competitors, M&A is probably going the optimum technique.

The Endava enterprise is a mix of a spread of manufacturers, a lot of which have been acquired to complement the broader group’s technological capabilities or its world attain. The corporate’s observe report has been constructive, noting a robust skill to determine alternatives and a selective method. That is important given the model picture it has created. That is necessary because the consulting business has skilled a interval of consolidation, driving up the buying and selling multiples of boutique companies.

The corporate focuses on constructing deep relationships with purchasers, looking for to know their distinctive wants, challenges, and targets. This fosters a long-term association with purchasers, permitting Endava to assist companies all through their progress trajectory and enhance the recurring nature of income.

Endava employs agile methodologies and lean practices to ship tasks effectively and iteratively, aligning with purchasers’ evolving necessities. Alongside this, the corporate invests closely in advertising and marketing its model and creating a robust tradition, all within the pursuit of taking a unique method to this business.

Monetary growth

Endava’s top-line efficiency is clearly extremely spectacular, as is its enterprise mannequin. The foundations underpinning this are simply nearly as good, suggesting sustainability in its progress trajectory.

The corporate’s high 10 purchasers are incrementally diluting over time, because the variety of big-ticket purchasers continues to extend, with over 150 purchasers contracted for >£1m.

Past this, common shopper spending is rising nicely, which suggests the deal with creating a long-term relationship with its purchasers to enhance upselling/cross-selling alternatives is succeeding.

Expertise Business

The technological revolution has continued to march on, as new applied sciences are developed and extra companies see the advantage of incorporating know-how into each side of their operations. That is changing into important for corporations to stay aggressive, as know-how reduces the worth of limitations to entry. We count on continued progress, with corporates using the likes of Endava and others to assist them on an ongoing foundation, because the panorama inside their business adjustments.

The present matter of the month is AI. We consider within the hype with AI, because it really has the potential to speed up the worth of companies offered by companies. With new corporations coming into the business every single day, corporates would require assist to navigate their decisions to seek out what finest service for his or her operation, which is the place Endava is available in. Much like how Cloud has pushed progress within the final decade, we suspect AI will preserve this trajectory going ahead.

Aggressive Positioning

We consider the next are aggressive benefits and engaging qualities of Endava:

- Custom-made Options – Endava’s skill to tailor options to every shopper’s particular wants has led to shopper satisfaction and loyalty. Its multi-brand, world method permits it to facilitate this seamlessly.

- Technological Experience – The corporate’s deep technical experience in varied areas, reminiscent of cloud computing, knowledge analytics, and rising applied sciences, positions it as a trusted accomplice. Endava’s willingness to amass the experience required, its want to develop a high-performing tradition, and its deal with recruiting extremely competent people, will solely improve this additional.

- Business Recognition – Endava’s status for delivering high-quality options has earned it a robust model, enhancing its credibility.

- Acquisitions and Growth – Endava’s strategic acquisitions and enlargement into new markets have contributed to its progress by broadening its service choices and shopper base.

- Numerous Portfolio – Providing a spread of companies permits Endava to handle a number of features of purchasers’ digital transformation journeys, widening its whole addressable market.

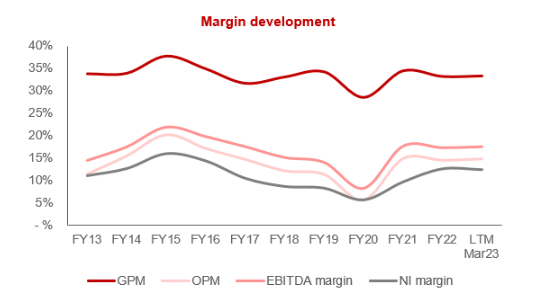

Margins

Margins (Endava)

Endava’s margins are spectacular, with broadly flat growth throughout this era. The corporate’s deal with advanced areas and a premium notion has allowed it to cost aggressively, to this point permitting for robust returns.

We do consider the present ranges are sustainable, though Endava will face aggressive pressures. It’s unlikely additional enchancment is feasible given the dearth of upward trajectory to this point.

Q3 outcomes

Introduced above is Endava’s most up-to-date quarterly outcomes. The important thing takeaways are:

- Endava’s top-line progress was +20.3%, with incremental margin enchancment (0.1ppts on NIM stage). The corporate’s progress illustrates its resilience to financial situations, though is under the expansion charge achieved traditionally.

- Headcount progress continues to be robust, with Administration dedicated to gaining market share and creating its experience throughout a interval of weak spot. Regardless of this, FCF has grown in extra of income, with no materials margin dilution.

Stability sheet & Money Flows

Endava’s stability sheet is clear. The corporate’s robust FCF enchancment has allowed it to make the most of money to amass companies, with a unfavourable ND stability. We suspect a FCF margin of 13-16% is sustainable going ahead.

Outlook

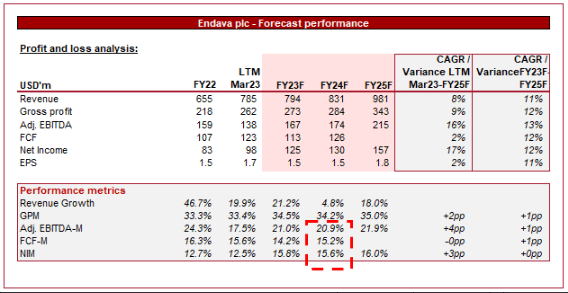

Outlook (Capital IQ)

Introduced above is Wall Avenue’s consensus view on the approaching 5 years.

Analysts are forecasting a softening of Endava’s progress charge, with a CAGR of 11% into FY25. Additional, margins are anticipated to normalize on the present ranges. Each assumptions seem broadly affordable, because the enterprise will inevitably face a slowdown, with M&A tough to forecast. Additional, the corporate’s margins are spectacular on an absolute foundation, making it tough to attain additional enchancment with scale.

Business evaluation

Introduced above is a comparability of Endava’s progress and profitability to the typical of its business, as outlined by Looking for Alpha (19 corporations).

Endava performs exceptionally nicely relative to its friends. The corporate’s progress is spectacular, reflecting its various method to successful purchasers and supporting progress by means of M&A.

Additional, Endava’s margins are comfortably above the typical, implying its deal with advanced technological capabilities and its advertising and marketing efforts have sufficiently differentiated the enterprise relative to its friends.

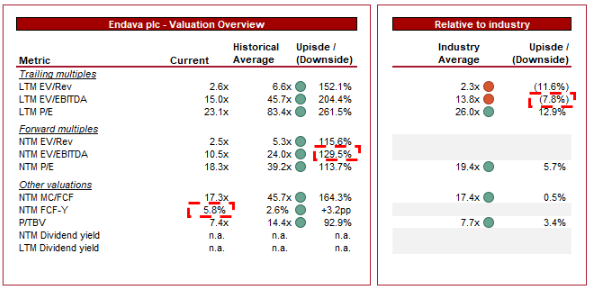

Valuation

Valuation (Capital IQ)

Endava is at the moment buying and selling at 15x LTM EBITDA and 11x NTM EBITDA. This can be a low cost to its historic common.

The corporate’s historic interval is brief so utilizing this as a benchmark has restricted advantages. The important thing cause for the low cost is a change in investor sentiment as to the corporate’s progress trajectory and scope for margin enchancment.

What is much extra necessary to think about is the corporate’s valuation relative to its friends. The corporate is buying and selling at a small premium on an LTM EBITDA foundation however a reduction on NTM FCF. This means worth in our view given the monetary outperformance achieved. Additional, the corporate has a a lot higher progress runway, notably because of its tendency towards bolt-ons.

The next graph illustrates the event of its attractiveness. As Endava’s buying and selling multiples have declined, its FCF yield has improved.

Valuation evolution (Capital IQ)

Key dangers with our thesis

The dangers to our present thesis are:

- Advertising and marketing – Endava’s advertising and marketing capabilities are superb. This can be a key a part of its go-to-market technique however makes us barely nervous {that a} diploma of the corporate’s premium is predicated on this. The danger that Endava sees erosion on this.

- Margin dilution – This can be a broader level just like the above. Given the simplification of the business because of the variety of large-scale members, the danger is that pricing stress begins to negatively impression Endava.

Last ideas

Endava is a high quality enterprise taking a barely completely different method to its rivals. This has allowed the enterprise to realize market share rapidly and obtain a formidable progress trajectory. Underpinning its robust model and advertising and marketing is deep experience and a razor-focused technique by Administration.

We consider business tailwinds, particularly AI and Cloud know-how, in addition to bolt-on acquisitions and the event of its relationships with present purchasers, will assist good progress within the coming years. Will or not it’s on the 35% CAGR, probably not, however we do assume the corporate can proceed to exceed its friends.

Regardless of the monetary growth throughout this era, Endava’s valuation has broadly declined, implying robust upside in our view.