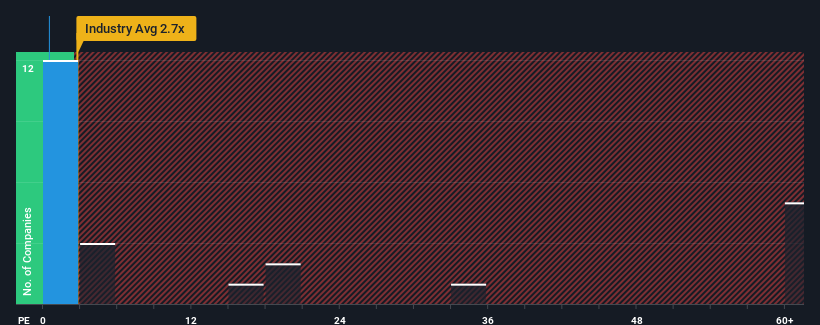

With a price-to-sales (or “P/S”) ratio of 0.5x SIMEC Atlantis Vitality Restricted (LON:SAE) could also be sending very bullish indicators in the mean time, given that nearly half of all of the Electrical firms in the UK have P/S ratios larger than 2.7x and even P/S larger than 20x will not be uncommon. Nonetheless, we would must dig a bit deeper to find out if there’s a rational foundation for the extremely lowered P/S.

View our latest analysis for SIMEC Atlantis Energy

What Does SIMEC Atlantis Vitality’s P/S Imply For Shareholders?

Current occasions have been fairly advantageous for SIMEC Atlantis Vitality as its income has been rising very briskly. Maybe the market is anticipating future income efficiency to dwindle, which has saved the P/S suppressed. Those that are bullish on SIMEC Atlantis Vitality will likely be hoping that this is not the case, in order that they will choose up the inventory at a decrease valuation.

We do not have analyst forecasts, however you’ll be able to see how latest tendencies are establishing the corporate for the long run by trying out our free report on SIMEC Atlantis Energy’s earnings, income and money move.

Do Income Forecasts Match The Low P/S Ratio?

With the intention to justify its P/S ratio, SIMEC Atlantis Vitality would wish to provide anemic development that is considerably trailing the {industry}.

If we evaluation the final 12 months of income development, the corporate posted a terrific enhance of 208%. The most recent three 12 months interval has additionally seen a wonderful 36% total rise in income, aided by its short-term efficiency. Accordingly, shareholders would have positively welcomed these medium-term charges of income development.

Evaluating the latest medium-term income tendencies towards the {industry}’s one-year development forecast of 88% exhibits it is noticeably much less enticing.

In mild of this, it is comprehensible that SIMEC Atlantis Vitality’s P/S sits beneath the vast majority of different firms. It appears most traders expect to see the latest restricted development charges proceed into the long run and are solely prepared to pay a lowered quantity for the inventory.

What Does SIMEC Atlantis Vitality’s P/S Imply For Buyers?

It is argued the price-to-sales ratio is an inferior measure of worth inside sure industries, however it may be a robust enterprise sentiment indicator.

In keeping with expectations, SIMEC Atlantis Vitality maintains its low P/S on the weak spot of its latest three-year development being decrease than the broader {industry} forecast. At this stage traders really feel the potential for an enchancment in income is not nice sufficient to justify a better P/S ratio. If latest medium-term income tendencies proceed, it is arduous to see the share worth expertise a reversal of fortunes anytime quickly.

It is all the time obligatory to contemplate the ever-present spectre of funding threat. We’ve identified 4 warning signs with SIMEC Atlantis Energy (at the very least 3 which make us uncomfortable), and understanding them ought to be a part of your funding course of.

If these dangers are making you rethink your opinion on SIMEC Atlantis Vitality, discover our interactive list of high quality stocks to get an thought of what else is on the market.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.