Traders are rising nervous of a pointy fall within the costs of dangerous company bonds as credit score circumstances for US companies and households develop more and more tighter.

The US Federal Reserve’s quarterly Senior Mortgage Officer Opinion Survey this week confirmed that 46 per cent of US banks plan to boost their lending requirements on account of worries about mortgage losses and deposit flight.

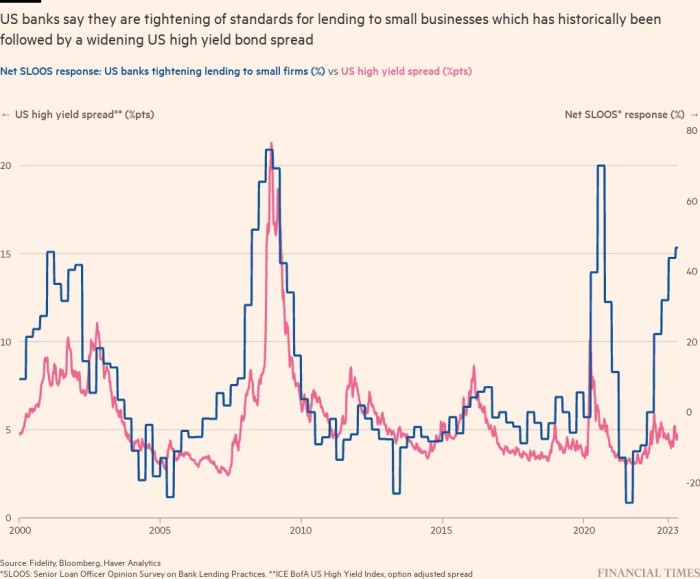

Up to now, tighter lending requirements have led to the unfold, or hole, between yields for riskier company bonds and ultra-safe authorities bonds widening, as a result of credit score turns into riskier to personal.

However whereas lending has not evaporated as feared following the collapse of Silicon Valley Financial institution in March, the unfold between higher-yield bonds and Treasuries has stayed comparatively tight, leaving buyers speculating {that a} correction is coming.

“By way of why company bond spreads haven’t but moved, I believe it’s just because lending requirements are a lead indicator on the actual economic system,” mentioned Mike Riddell, a bond fund supervisor at Allianz International Traders.

“We predict that world threat premia will transfer sharply greater as soon as the exceptionally tight lending requirements start to have a serious affect on world development, which is because of occur imminently.”

Finally, he mentioned, it takes at the least a 12 months for a change in rates of interest to have the total affect on the economic system. The Fed began elevating charges in March final 12 months.

Traders’ worries over the well being of the US banking system are nonetheless rippling by way of markets, greater than two months for the reason that failure of SVB. PacWest shares have misplaced greater than a fifth in worth this week after the financial institution introduced it misplaced virtually a tenth of its deposits within the first week of Might. The KBW regional banks index, which tracks midsized and native US banks, has shed 35 per cent for the reason that begin of the 12 months.

“The failures of a number of banks in current months have been comparatively nicely contained, and a 2008-style disaster appears to be like a lot much less seemingly than it did when Silicon Valley Financial institution collapsed in March,” mentioned Eugene Philalithis, head of multi-asset investments at Constancy. “Nonetheless, the US banking sector stays in a slow-motion crunch.”

Constancy believes high-yield US bonds look significantly susceptible to tighter lending. Spreads are at ranges according to a “extra benign outlook than actuality suggests”, in line with Philalithis, who’s shopping for extremely rated sovereign bonds and avoiding dangerous credit score.

Howard Cunningham, mounted earnings portfolio supervisor at Newton Funding Administration, has mentioned he has additionally “sharply diminished” publicity to high-yield bonds as a result of “the place lending requirements go junk bond yields will comply with”.

In its monetary stability report earlier this week, the Fed cited the possibility of a credit score crunch among the many greatest present dangers to the monetary system however not the Fed’s more than likely state of affairs.