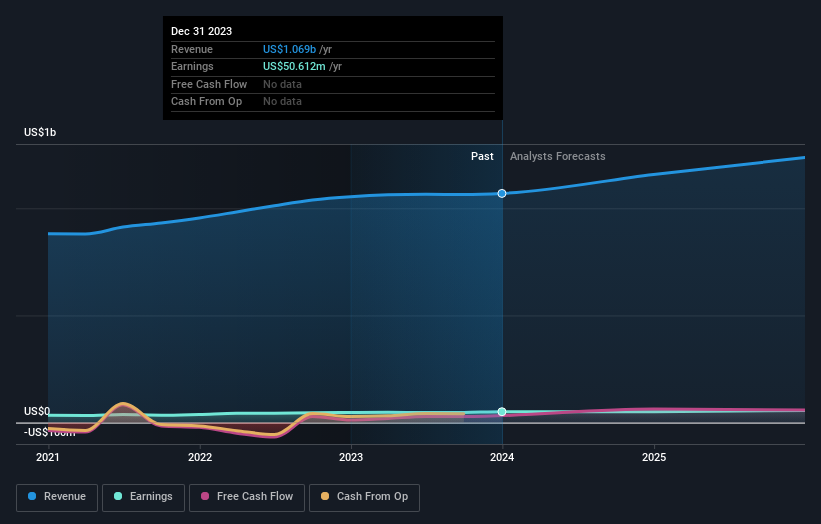

Traders in Barrett Enterprise Companies, Inc. (NASDAQ:BBSI) had a very good week, as its shares rose 4.2% to shut at US$120 following the discharge of its full-year outcomes. Barrett Enterprise Companies reported US$1.1b in income, roughly according to analyst forecasts, though statutory earnings per share (EPS) of US$7.39 beat expectations, being 3.6% larger than what the analysts anticipated. This is a vital time for buyers, as they will monitor an organization’s efficiency in its report, have a look at what consultants are forecasting for subsequent 12 months, and see if there was any change to expectations for the enterprise. With this in thoughts, we have gathered the newest statutory forecasts to see what the analysts predict for subsequent 12 months.

See our latest analysis for Barrett Business Services

Making an allowance for the newest outcomes, the latest consensus for Barrett Enterprise Companies from 4 analysts is for revenues of US$1.16b in 2024. If met, it could suggest a good 8.3% improve on its income over the previous 12 months. Statutory per-share earnings are anticipated to be US$7.66, roughly flat on the final 12 months. Within the lead-up to this report, the analysts had been modelling revenues of US$1.15b and earnings per share (EPS) of US$7.70 in 2024. So it is fairly clear that, though the analysts have up to date their estimates, there’s been no main change in expectations for the enterprise following the newest outcomes.

With the analysts reconfirming their income and earnings forecasts, it is stunning to see that the value goal rose 9.9% to US$144. It seems as if they beforehand had some doubts over whether or not the enterprise would reside as much as their expectations. Fixating on a single worth goal may be unwise although, for the reason that consensus goal is successfully the common of analyst worth targets. Because of this, some buyers like to have a look at the vary of estimates to see if there are any diverging opinions on the corporate’s valuation. There are some variant perceptions on Barrett Enterprise Companies, with essentially the most bullish analyst valuing it at US$159 and essentially the most bearish at US$135 per share. Nonetheless, with such a good vary of estimates, it suggeststhe analysts have a fairly good concept of what they suppose the corporate is value.

Trying on the larger image now, one of many methods we will make sense of those forecasts is to see how they measure up in opposition to each previous efficiency and industry development estimates. It is clear from the newest estimates that Barrett Enterprise Companies’ fee of development is anticipated to speed up meaningfully, with the forecast 8.3% annualised income development to the top of 2024 noticeably sooner than its historic development of three.4% p.a. over the previous 5 years. Against this, our information means that different firms (with analyst protection) in an analogous business are forecast to develop their income at 6.4% per 12 months. It appears apparent that, whereas the expansion outlook is brighter than the current previous, the analysts additionally count on Barrett Enterprise Companies to develop sooner than the broader business.

The Backside Line

An important factor to remove is that there is been no main change in sentiment, with the analysts reconfirming that the enterprise is performing according to their earlier earnings per share estimates. Fortunately, there have been no main modifications to income forecasts, with the enterprise nonetheless anticipated to develop sooner than the broader business. We be aware an improve to the value goal, suggesting that the analysts believes the intrinsic worth of the enterprise is probably going to enhance over time.

Following on from that line of thought, we predict that the long-term prospects of the enterprise are far more related than subsequent 12 months’s earnings. We’ve got estimates – from a number of Barrett Enterprise Companies analysts – going out to 2025, and you’ll see them free on our platform here.

You may also see our analysis of Barrett Business Services’ Board and CEO remuneration and experience, and whether company insiders have been buying stock.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by basic information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.