Even when a enterprise is shedding cash, it is attainable for shareholders to earn money in the event that they purchase an excellent enterprise on the proper worth. For instance, Corvus Prescribed drugs (NASDAQ:CRVS) shareholders have completed very effectively over the past yr, with the share worth hovering by 226%. Nonetheless, solely a idiot would ignore the danger {that a} loss making firm burns by its money too rapidly.

Given its robust share worth efficiency, we expect it is worthwhile for Corvus Prescribed drugs shareholders to contemplate whether or not its money burn is regarding. On this report, we are going to think about the corporate’s annual detrimental free money stream, henceforth referring to it because the ‘money burn’. Let’s begin with an examination of the enterprise’ money, relative to its money burn.

View our latest analysis for Corvus Pharmaceuticals

Does Corvus Prescribed drugs Have A Lengthy Money Runway?

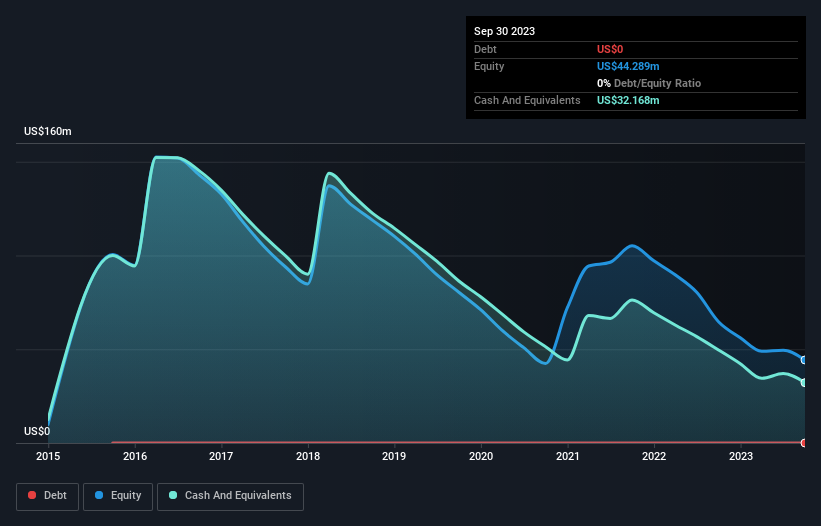

A money runway is outlined because the size of time it might take an organization to expire of cash if it saved spending at its present charge of money burn. In September 2023, Corvus Prescribed drugs had US$32m in money, and was debt-free. Importantly, its money burn was US$26m over the trailing twelve months. So it had a money runway of roughly 15 months from September 2023. That is not too dangerous, nevertheless it’s truthful to say the top of the money runway is in sight, except money burn reduces drastically. The picture beneath reveals how its money steadiness has been altering over the previous couple of years.

How Is Corvus Prescribed drugs’ Money Burn Altering Over Time?

Corvus Prescribed drugs did not document any income over the past yr, indicating that it is an early stage firm nonetheless growing its enterprise. So whereas we will not look to gross sales to know development, we will take a look at how the money burn is altering to know how expenditure is trending over time. It appears probably that the enterprise is content material with its present spending, because the money burn charge stayed regular over the past twelve months. Clearly, nevertheless, the essential issue is whether or not the corporate will develop its enterprise going ahead. For that motive, it makes a whole lot of sense to try our analyst forecasts for the company.

How Arduous Would It Be For Corvus Prescribed drugs To Elevate Extra Money For Progress?

Whereas Corvus Prescribed drugs is exhibiting a strong discount in its money burn, it is nonetheless price contemplating how simply it may increase extra cash, even simply to gas sooner development. Usually talking, a listed enterprise can increase new money by issuing shares or taking up debt. One of many important benefits held by publicly listed firms is that they will promote shares to buyers to boost money and fund development. By evaluating an organization’s annual money burn to its whole market capitalisation, we will estimate roughly what number of shares it must problem so as to run the corporate for an additional yr (on the identical burn charge).

Because it has a market capitalisation of US$104m, Corvus Prescribed drugs’ US$26m in money burn equates to about 25% of its market worth. That is pretty notable money burn, so if the corporate needed to promote shares to cowl the price of one other yr’s operations, shareholders would endure some pricey dilution.

So, Ought to We Fear About Corvus Prescribed drugs’ Money Burn?

Though its money burn relative to its market cap makes us somewhat nervous, we’re compelled to say that we thought Corvus Prescribed drugs’ money runway was comparatively promising. Though we do not suppose it has an issue with its money burn, the evaluation we have completed on this article does counsel that shareholders ought to give some cautious thought to the potential value of elevating more cash sooner or later. On one other be aware, Corvus Prescribed drugs has 5 warning signs (and 2 which are potentially serious) we expect you need to find out about.

After all Corvus Prescribed drugs is probably not one of the best inventory to purchase. So chances are you’ll want to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to carry you long-term targeted evaluation pushed by basic information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.